The IRS officially opened for the 2014 tax season today and a common question asked around this time is “Where’s My Refund?”

Many taxpayers also have questions about how the process of getting tax refunds and refund timing works.

We know you work hard for your money and wanted to answer some of the most common questions we see about the issuance of tax refunds.

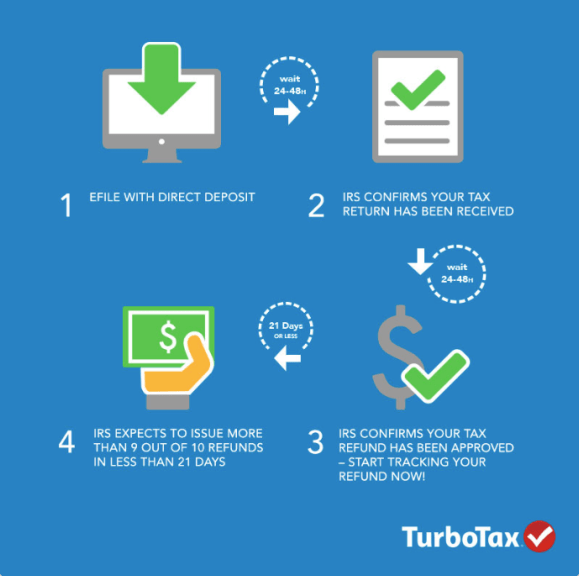

Here is a breakdown of how your tax return will progress through 3 stages with the IRS -“Return Received”, “Return Approved”, and “Refund Sent” once you e-file and where you can go to check your refund status so you understand “Where’s My Refund?”:

Refund Process

- Start checking status 24 – 48 hours after e-file – Once you e-file with direct deposit, you can start checking the status of your return 24 – 48 hours after you e-file on the IRS Where’s My Refund tool.

- Return Received Notice within 24 – 48 hours after e-file – The IRS Where’s My Refund tool will show “Return Received” status once they begin processing your tax return. You will not see a refund date until the IRS finishes processing your tax return and approves your tax refund.

- Status change from “Return Received” to “Refund Approved” – Once the IRS finishes processing your tax return and confirms your tax refund is approved, your status will change from “Return Received” to “Refund Approved”. Sometimes the change in status can take a few days, but it could take longer and a date will not be provided in Where’s My Refund? until your tax return is processed and your tax refund is approved.

- Where’s My Refund? tool shows refund date – The IRS will provide an actual refund date once your status moves to “Refund Approved”. The IRS issues more than 9 out of 10 refunds in 21 days or less.

- Where’s My Refund? shows “Refund Sent” – You’re now closer to your biggest tax refund! If the status in Where’s My Refund? shows “Refund Sent”, the IRS has sent your tax refund to your financial institution for direct deposit. It can take 1 to 5 days for your financial institution to deposit funds into your account. If you requested that your tax refund be mailed, it could take several weeks for your check to arrive.

Here are more answers to your common questions about your tax refund:

Will I see a date right away when I check status in “Where’s My Refund”?

Where’s My Refund will not give you a date until your tax return is received, processed, and your tax refund is approved by the IRS

It’s been longer than 21 days since the IRS has received my tax return and I have not received my tax refund. What’s happening?

Some tax returns take longer than others to process depending on your tax situation. Some of the reasons it may take longer are incomplete information, an error, or the IRS needs to review it further.

What other sources can I use to check my refund status?

Once you have e-filed your tax return with TurboTax, you can check your status using MyTurboTax. You can even check your status on the go from your mobile device using TurboTax free app MyTaxRefund.

If you haven’t e-filed your taxes yet, you can start today. You may even be able to e-file your federal tax return for free and have your biggest tax refund in your pocket within 21 days.