Whether you’re uninsured or searching for more affordable health insurance, you will be able to shop for health insurance in state and federally run marketplaces beginning October 1, 2013.

Under health care reform, state and federally-run marketplaces or exchanges will be open to help you compare plan options and purchase health insurance.

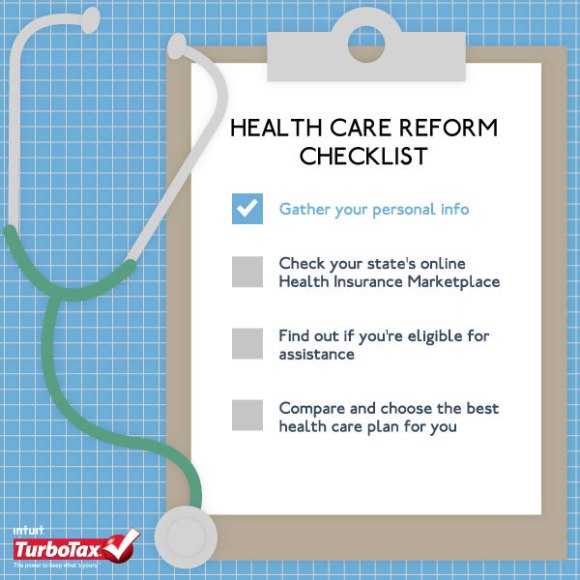

As time draws near, you may be wondering what you can do to get ready to purchase health insurance in the Health Insurance Marketplace. Our checklist will help you get ready:

- Gather personal information for every family member who needs coverage – The IRS will report income information to exchanges from your 2012 tax return, but it’s best to have an idea of your total household income to see what type of health insurance you’re eligible for and if you will be eligible for government assistance to help you pay for your insurance.

You can get this income information from your W-2s, tax returns, and current pay stubs. You will also need social security numbers for household members.

Quick Tip: Find out if your employer is offering health insurance and what types they are offering – Knowing what your employer is offering will help you decide whether you want to enroll in employer provided insurance or purchase through the exchange. If your employer is not offering health insurance you may be required to get health insurance by March 31, 2014 or face a penalty.

- Check your state’s online Health Insurance Marketplace – Learn what type of health insurance is available to you. Understanding the types of coverage and how the coverage works will help you choose a health plan that’s right for you.

- Find Out if You’re Eligible for Assistance – Depending on your household income, you may be eligible for a subsidy or tax credit, which will assist you in purchasing your health insurance.

Quick Tip: You may need to provide information about current insurance you have or are eligible for. If you already have health insurance and decide to purchase through the Health Insurance Marketplace you’ll need to provide your current health information.

- Compare and Choose the Best Health Care Plan for You – There will be different health plans available. Knowing what health insurance options are available, costs, and whether or not you will receive a subsidy will help you decide which plan fits your budget and how much you need to set aside each month to purchase insurance.

Don’t forget TurboTax has you covered. As with any tax laws, TurboTax is up to date with the latest tax law changes and if you have questions about the new health care law, we have answers to help you understand how the new law impacts you.